Understanding Website Flipping

The Basics of Website Flipping

Website flipping is increasingly becoming a lucrative opportunity in the world of digital business. At its core, it refers to the process of buying a website with the intent of improving it and then selling it for a profit. This strategy is similar to real estate flipping but is focused on the online space. Whether it's through increasing monthly revenue or enhancing digital marketing efforts, the goal is straightforward: boost the website's net profit.

Why Consider This Digital Business Model?

Website flipping offers a dynamic way to delve into the online business arena with potentially high returns. The rapid growth of ecommerce, SaaS ecommerce, and Amazon FBA businesses stand testament to the robust marketplace out there. Buying an online business is an attractive proposition if you can spot opportunities where improvements can increase both the traffic and the appeal of the platform.

Types of Websites in Focus

Investors often look at various business models when flipping websites, including Amazon Associates, FBA Amazon, SaaS businesses, digital products, and more. The choice largely depends on one’s expertise and interest. For instance, a person with expertise in Amazon FBA might find value in businesses focused on product listings and optimized sales funnels.

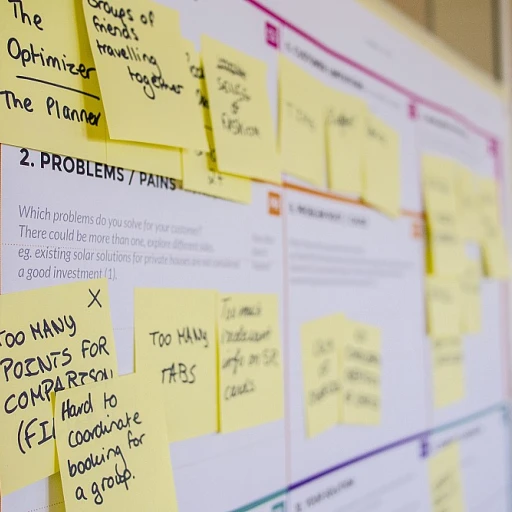

Creating Value in Online Businesses

Successful website flipping often involves revamping poorly performing listings, optimizing content, and enhancing user experience to boost both monthly views and cash flow. Attention to these details not only maximizes visibility but also repositions the business for future success when you decide to list the website for sale.

By understanding the foundational elements of website flipping, you’re setting the stage for evaluating a website's true worth. With a strategic approach, you'll be better equipped to identify profitable online businesses ripe for transformation.

Identifying Profitable Online Businesses

Discovering Lucrative Digital Ventures

In the dynamic digital marketplace, identifying profitable online businesses to invest in requires keen insight and strategic judgment. A diverse array of opportunities exists, from e-commerce platforms thriving on Amazon FBA to subscription-based SaaS businesses.

Success in website flipping hinges on discerning the characteristics of high-potential ventures. Focus on businesses with steady monthly revenue and cash flow. Whether it's an Amazon FBA business, a content-driven website, or a digital product platform, ensure that the net profit is both substantial and sustainable.

- E-commerce Sites: These continue to be a powerhouse, especially those that integrate Amazon services like Amazon Associates and Amazon FBA.

- Subscription Models: SaaS businesses and digital memberships often offer reliable recurring revenue.

- Listing Metrics: Regular updates on listing views and engagement can help gauge market interest before investing.

Moreover, seek out businesses that have scope for further optimization and growth, ensuring you can boost both their value and your eventual sale price. Mastering the art of finding and investing in the right opportunity takes time and diligence, but can significantly enhance your portfolio.

Evaluating Website Value

Key Factors for Assessing a Website's Worth

When embarking on the journey of website flipping, evaluating the worth of a potential acquisition is crucial. Various elements contribute to determining the actual value of online businesses, and understanding these can help you make informed decisions.- Revenue and Net Profit: The primary measure of a website's value is its revenue and net profit. Monthly revenue figures offer a view into the site's earning potential, while net profit shows the actual take-home cash flow after expenses. These metrics are especially vital when considering ecommerce sites, digital marketing platforms, or amazon FBA businesses.

- Business Type and Model: The business model also plays a significant role. For instance, the growth potential of a saas business may differ from an amazon associates website. An ecommerce platform leveraging amazon FBM or FBA amazon strategies may present various opportunities compared to a digital product or content site.

- Market Trends and Demand: Keeping abreast of market trends can provide insights into the sustainability and scalability of your investment, whether it's an amazon KDP or an established online store.

- Digital Presence and Traffic: Analyzing traffic trends, sources, and stability is critical. High traffic doesn't always equate to high sales, but consistent growth patterns can lead to lucrative businesses sale options in the future.

- Growth Potential: A strong potential for growth can dramatically increase a website's attractiveness. Optimizing the acquisition for enhanced performance, such as through improved digital marketing or better Amazon FBA strategies, can boost the value significantly.

- SaaS Potential: Assessing opportunities in saas ecommerce is essential, as these businesses often yield recurring revenue and can be scaled more predictably. This guide provides more insights into evaluating saas businesses within the digital landscape.

Negotiating the Purchase

Sealing the Deal in Online Business Acquisitions

After identifying and evaluating a promising website to acquire, the next crucial step is negotiating the purchase. This stage is essential whether you're buying into the thriving world of ecommerce, SaaS, or content-based websites. To successfully negotiate, you must understand the financial landscape of the business at hand. This includes examining the monthly revenue, net profit, and cash flow of the business. Consider the type of business model, whether it's an Amazon FBA, digital product, or SaaS business, as it will influence the purchase price. Understanding these aspects will help you articulate a stronger position in your negotiation. It's vital to engage in due diligence. This means verifying that the business is as advertised, checking for red flags, and understanding the reasons for selling. If the business is listed at a competitive price, its performance metrics like the previous months' revenue streams, net income, or Amazon FBM listings should reflect sustainable growth patterns. Here are a few tips to navigate this process effectively:- Due Diligence: Review all available records, including financial statements, customer reviews, and traffic data to assess the health of the business. This is particularly crucial for ecommerce platforms, Amazon KDP, Amazon Associates, or digital marketing ventures.

- Leverage Professional Help: Hiring an experienced broker or consultant could provide insights into the fair market value and offer negotiation tactics. This is often seen with complex businesses sale or larger listings on online business marketplaces.

- Understand Seller Motivation: Knowing why the seller wants to exit can reveal opportunities to make a favorable offer. For instance, a seller eager to offload a high-demand Amazon business might be willing to negotiate a quick sale.

- Craft a Win-Win Offer: Propose terms that benefit both parties. This might include flexible payment structures, a phased acquisition, or tying a portion of the price to future performance for websites sale that are not cash-rich.

Optimizing and Growing Your Acquisition

Maximizing Potential: Enhancement Strategies for Your Website Purchase

Once you've acquired a website, whether it’s an ecommerce platform, a digital product site, or an SAAS business, it’s time to focus on optimization and growth. Turning your investment into a profitable venture is the ultimate goal and entails strategic improvements and operational changes to boost its value. First, analyze the existing content and listing. Content is king in the digital marketing world, and enhancing it can significantly increase your monthly views and revenue. Consider integrating additional keywords that cater to the target audience, offering fresh perspectives, and regular updates. This will not only help in SEO but also attract more traffic. In the realm of ecommerce and Amazon FBA businesses, the efficiency of your inventory management can make or break your success. For FBA businesses, ensure your listings are optimized and appealing, so potential buyers can easily view and be tempted to purchase your products. The same attention should be given to SAAS businesses—enhance features and customer support to improve user satisfaction. Improving user experience isn't limited to just the functionality; it’s also about aesthetics. A visually appealing and easy-to-navigate website can lead to lower bounce rates and higher engagement levels, which directly impacts your net profit. Consider increasing diversification of revenue streams. If you're dealing with digital products, explore expanding your offerings. For associations like Amazon Associates, ensure you’re maximizing potential commissions without compromising user experience. Finally, monitor your cash flow closely. Keeping a keen eye on financial metrics such as net revenue and monthly earnings will help you make informed decisions about further investments, pricing strategies, and when it might be opportune to consider exiting for sale profitably. Your end goal should be to build a robust online presence that provides a competitive edge, enhances value, and sets the stage for a profitable exit strategy when the time is right.Exiting with Profit: Selling Your Website

Securing a Profitable Exit Strategy

Navigating your way through the website flipping landscape ultimately leads to the rewarding moment of selling your well-curated online business. With careful execution, your months of strategic planning and optimization can culminate in a lucrative sale. The decision to list your digital asset for businesses sale should be informed by your overall objectives—whether you aim to reinvest in new opportunities or enjoy the fruits of your digital entrepreneurship. Here's a guide to ensure your sale is both satisfactory and profitable:- Understand the Market: Research current trends in sites like ecommerce platforms, Amazon FBA, or SaaS businesses to gauge the demand and set realistic expectations for your sale. High-performing sectors like digital product offerings or Amazon listings can offer profitable exits when net profit and cash flow are strong.

- Optimize Listing Details: A compelling website for sale needs clear, concise, and attractive descriptions. Highlight key metrics like monthly net revenue, digital marketing efforts, and overall business health to attract potential buyers.

- Choose the Right Platform: Consider platforms that specialize in listing online businesses, ensuring exposure to qualified buyers interested in buying and selling digital properties. Marketplaces relevant to your site, whether it's a SaaS business or an Amazon Associates niche website, can provide targeted traffic.

- Work with Professionals: Engage with experts in businesses sale, such as brokers or digital marketing consultants, who can offer critical help in refining your pricing and negotiating terms.

- Price Correctly: Position your website at a competitive yet profitable price point. Factor in established revenue streams from ventures like Amazon FBM or Amazon KDP, along with any growth potential your site possesses.